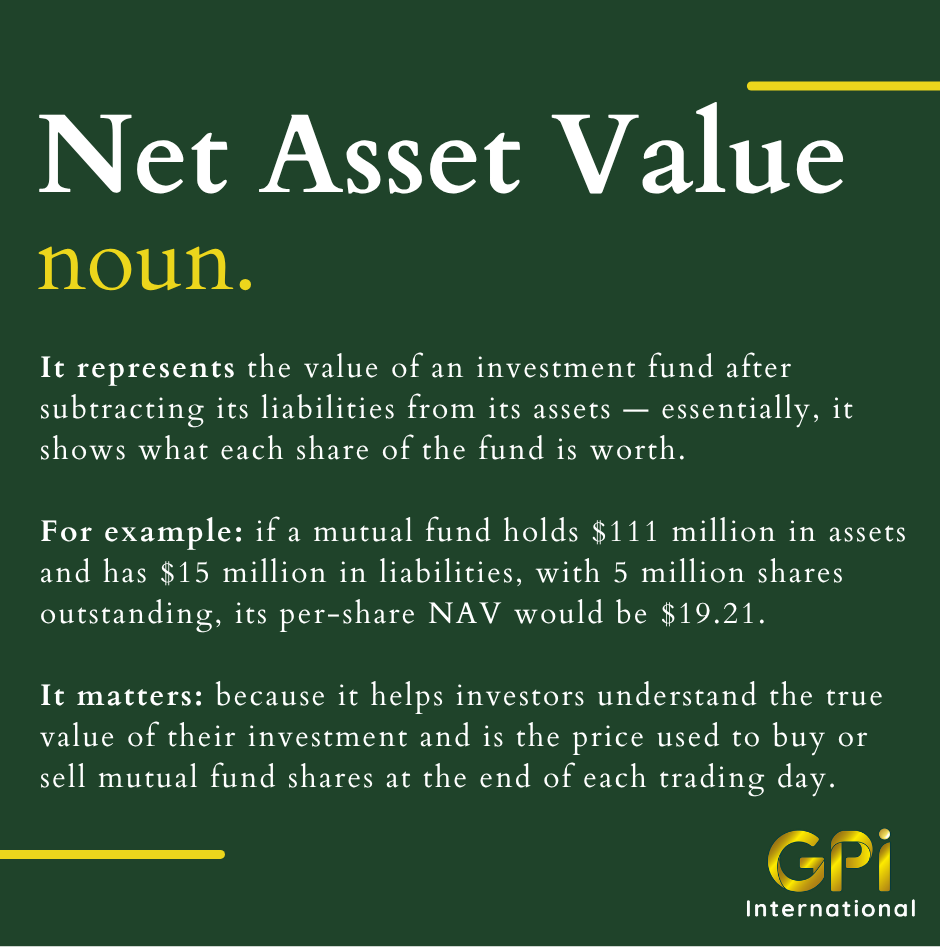

Net Asset Value

Net Asset Value (NAV) is a fundamental concept in the world of investing, particularly when it comes to mutual funds, exchange-traded funds (ETFs), and other pooled investment vehicles. In simple terms, NAV represents the per-share value of a fund’s assets after subtracting liabilities. It tells investors how much each share of the fund is worth at a given point in time.

How NAV Is Calculated

The formula for calculating NAV is straightforward:

NAV = (Total Assets – Total Liabilities) / Number of Outstanding Shares

- Total Assets include all the holdings in the fund — such as stocks, bonds, cash, and dividends receivable.

- Total Liabilities might include management fees, administrative expenses, and other costs the fund owes.

- Outstanding Shares refer to the total number of fund units held by investors.

Example:

Imagine a mutual fund that holds $111 million in assets and has $15 million in liabilities, with 5 million shares outstanding.

NAV = (111,000,000 – 15,000,000) / 5,000,000

NAV = 96,000,000 / 5,000,000 = $19.20

So, each share of the fund would be worth $19.20.

Why NAV Matters

NAV is crucial because it’s the price at which investors buy or sell shares of a mutual fund. Unlike stocks, which trade throughout the day and whose prices fluctuate constantly, mutual fund shares are priced once per day, after the market closes. This is when the fund calculates its NAV based on the value of its assets and liabilities at the end of the trading day. For ETFs, the concept of NAV still applies, but ETFs also trade like stocks on an exchange, so their market price may deviate slightly from the actual NAV during the day.

NAV vs. Performance

It’s important to note that a higher NAV doesn’t mean a better fund. NAV is not a performance metric — it simply reflects the per-share value of a fund’s holdings. A fund with a lower NAV might have outperformed one with a higher NAV, depending on how its assets have grown over time. To assess a fund’s performance, investors should look at its total return (which includes capital gains and dividends), expense ratio, historical growth, and how well it meets investment goals.

NAV is a core concept in fund investing that helps determine the value of your holdings. Understanding how it works gives investors a clearer picture of what their investments are worth and ensures they make informed decisions when buying or selling fund shares.