Investment markets expectations for 2022

Climate change

Climate change was the number one danger by respondents in the World Economic Forum’s annual risks report. Extreme weather was considered the world’s biggest risk in the short term and a failure of climate action in the medium and long term – two to 10 years, the survey showed. Agreement at the U.N. COP26 climate conference in November last year was widely applauded for keeping alive prospects of capping global warming at 1.5 degrees Celsius. Financing and proper measures are expected to grow

ESG

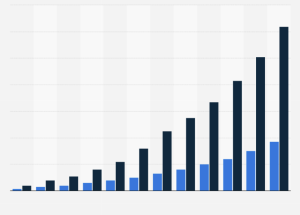

Overall climate adaptation will double to $2 trillion per year within the next five years. The UN’s Global Commission on Adaptation says a $1.8 trillion investment by 2030 in early warning systems, resilient infrastructure, dryland crop agricultural production, mangroves, and water resource management would yield more than $7 trillion of benefits in avoided costs from climate change effects.

Focus: USA

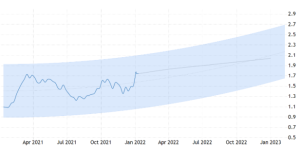

Pay attention to the timing and pace of monetary policy normalisation.

According to the Fed meeting in December, the Fed may be more aggressive in finishing stimulus, given the powerful post-pandemic recovery (see below). Markets are coming to terms with the scenario of interest rates increasing at a faster pace than previously expected. It is expected that in 2022 the rate may be raised 3-4 times. This puts value stocks under pressure and thus large cap, solid balance sheets are the most sensible focus.

Europe

In contrast to U.S. equities, stock markets in Europe are more reasonably priced and geared toward growth.

The MSCI Europe index has enjoyed its best period of relative outperformance in 20 years compared to the rest of the world, and that pattern should continue thanks to increased mergers and acquisitions, buyback activity and changes in investor positioning since many global portfolios had been underexposed to the region in favour of the overheating US.

China

In 2021 Chinese stocks mainly declined due to changes in foreign investors who were frightened by regulatory uncertainty. However…

…there is an important factor playing in favour of the growth of the Chinese market in 2022. While most world central Banks are looking for Monetary policy tightening and balance sheets normalisation, China took steps to ease its monetary policy: in 2021 it lowered 2 times the required bank reserve ratio, and also cut the LPR annual lending rate. Therefore, the market expects that the West will be curtailing stimulus and raising rates, the reverse process will unfold in China. Whether this will keep Chinese stocks afloat during the tightening of monetary policy in the US is difficult to say – it depends on the scale of stimulus in China.

Bond markets

Central banks in developed markets responded to the COVID-19 pandemic with near-uniform interest policies and a deluge of liquidity. In 2022, however, bond markets will need to make sense of differentiated policies. Policy comparisons between the UK and the US for example, are oceans apart. Rising inflation will impact the already beleaguered asset class in the West. Emerging market debt will start to look interesting, especially if the USD FX rate cools.

COMMODITIES

Oil at $100. Gold at $2,000

Oil pricing is cushioned on near term supply shock from geopolitical fears. On the other hand, oil has always been considered as a hedge against unexpected inflation. The high rate of inflation in the world spurs commodity quotes. Inflation in the US was at its highest since 1982. Annual inflation in the Eurozone at the end of 2021 was 5% after 4.9% in November. Gold prices have been supported by stagflation concerns and rate hike expectations, while base metals have benefited from the combination of constrained supply and rising demand. The traditional belief that gold is a hedge against inflation will benefit the metal, as well as increased demand from the reopening trade.